The format suggested in this chapter is for. Any Loan Taken Or Repaid 20000 In Cash.

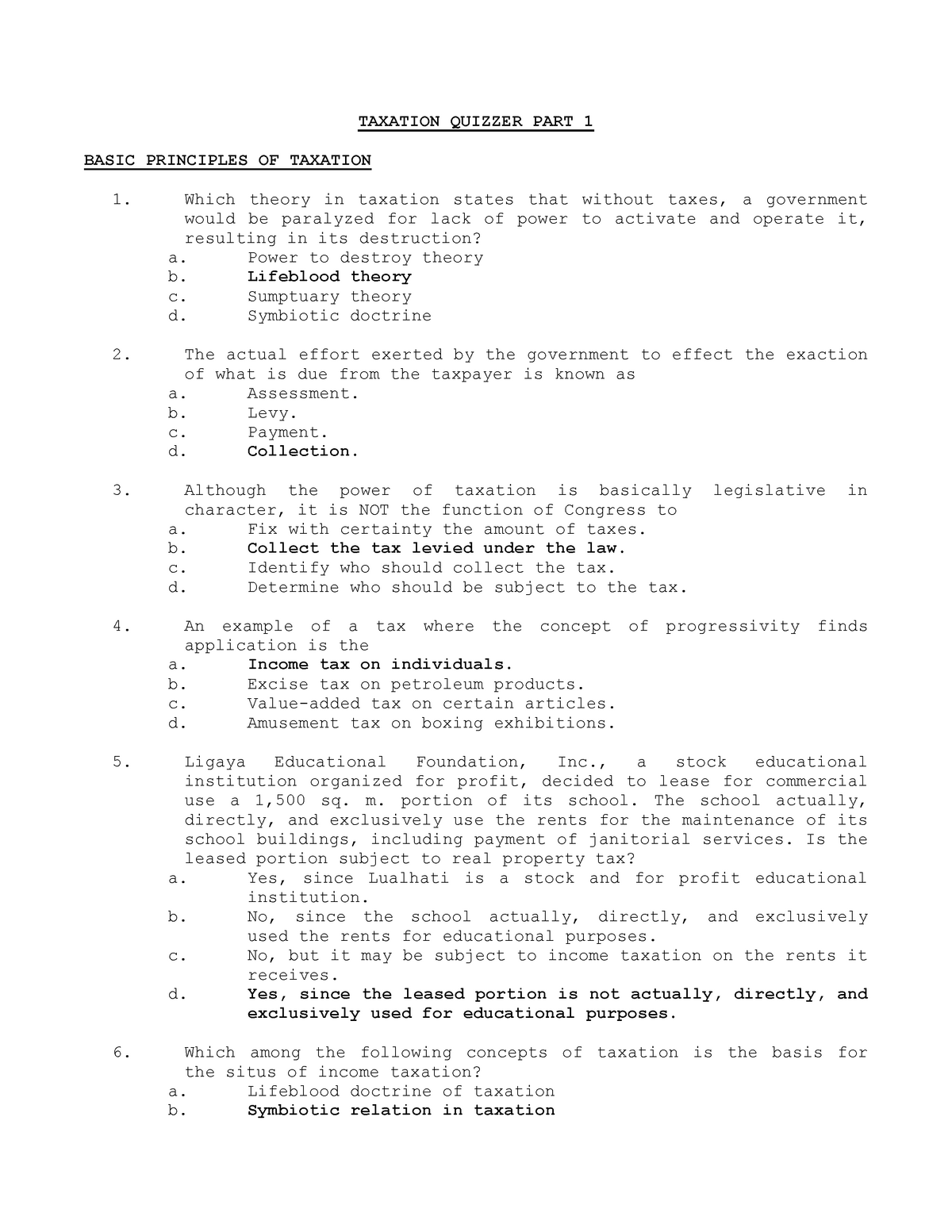

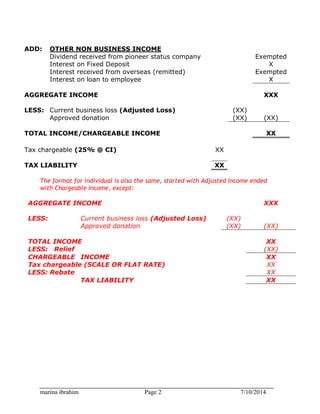

NON BUSINESS INCOME X Dividend received As per PL acc X Interest received As per PL acc X Interest on loan to employee X ADD.

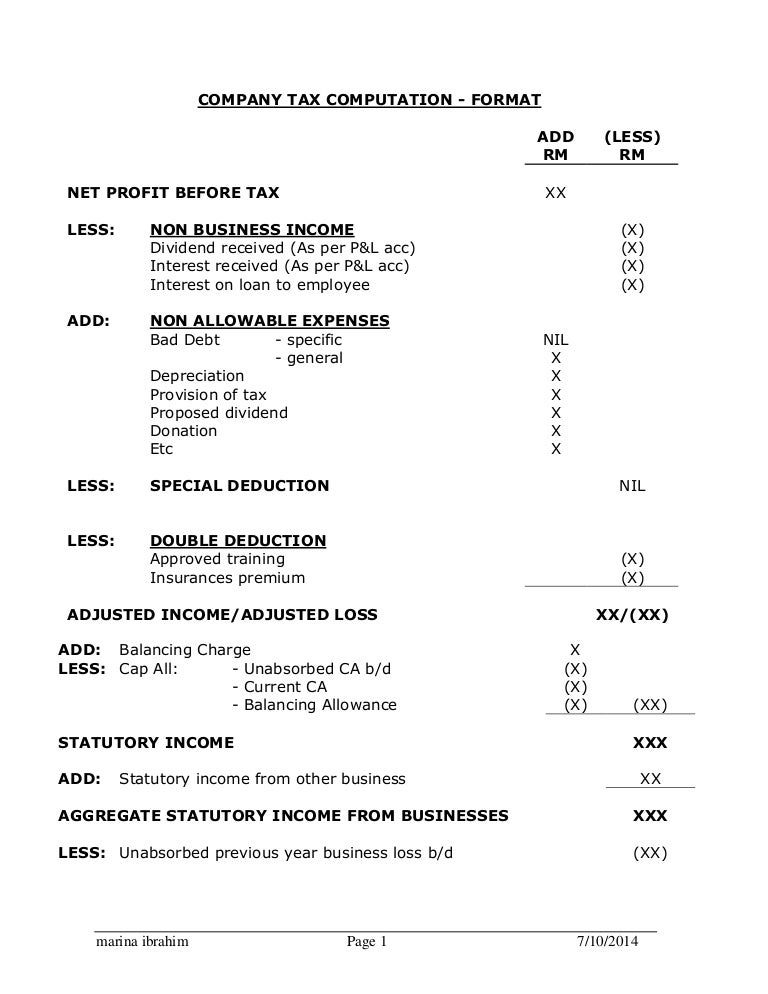

. Following table will give you an idea about company tax computation in Malaysia. It is important to note that the burden of computing tax liabilities accurately is on the company and accordingly tax payers are expected to compute taxes while obeying taxation laws and guidelines issued by the Malaysian Inland Revenue Board IRB. Contoh Format Baucar Dividen.

Calculate monthly net salary tax on annual bonus. The company tax system of Malaysia is considered a major contributor to the economic development of the country. For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia.

TAX RATES AND ALLOWANCES The following tax rates allowances and values are to be used in answering the questions. All income tax calculations are automated. Includes medical tax credits UIF pension deductions.

Resident companies are taxed at the rate of 24. Malaysia updated october 2017 b a company is so related to another company which is itself so related to a third company. Rate On the first RM600000 chargeable income.

The current CIT rates are provided in the following table. 235723 Cost of sales Less. Azreens income tax in 2017.

Last reviewed - 13 June 2022. Instructions about how to complete each label on the company tax return. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

Chargeable income MYR CIT rate for year of assessment 20212022. 33 taxable income and rates. Headquarters of Inland Revenue Board Of Malaysia.

MM Manufacturing Sdn Bhd Tax computation for the year of assessment 2017. Calculates income tax based on variable monthly remuneration. Provided by in the tax laws.

On the chargeable income exceeding RM600000. 5 Under the self-assessment system an assessment is deemed to have been made by the Director General of Inland Revenue on the date the tax return is submitted The above statement is. Rate The first RM600000.

For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600000 will be tax at 24. Paid-up capital up to RM25 million or less. In that case the donation paid by Sabah Berjaya Sdn Bhd to Sabah Foundation was treated as allowable under S44 6 of the ITA 1967.

Add Ded - Note RM000 RM000 RM000 Business income Profit before taxation. RM300 lets call it ZC IT ZC Amount of Income Tax that Azreen would need to pay. Use for multiple tax years.

The meetings of its board of directors are held in Malaysia even though the company is not incorporated in Malaysia. What Are the Perquisites Perks Given to Employees. Hence corporate tax revenue is one of the most primary sources of income in Malaysia.

Corporate tax computation Malaysia is also a part of SAS. NON ALLOWABLE EXPENSES Drawings COGS X Holidayleave passage X Bad Debt. No guide to income tax will be complete without a list of tax reliefs.

Return Form RF Filing Programme. Headquarters of Inland Revenue Board Of Malaysia. Tax evasion is deliberate or wilful intention to reduce tax liability using illegal means.

NON BUSINESS INCOME X Dividend received As per PL acc X Interest received As per PL acc X Interest on loan to employee X ADD. Company tax computation format 1. A True B False C True only for companies D True only for individuals and non-corporates 6 Lee is a Canadian employed by a Malaysian company.

While the 28 tax rate for non-residents is a 3 increase from the previous years 25. Regulation in network and service sectors 2018. Malaysia Taxation and Investment 2016 Updated November 2016 Contents 10 Investment climate 11 Business environment 12 Currency 13 Banking and financing 14 Foreign investment 15 Tax incentives 16 Exchange controls 20 Setting up a business 21 Principal forms of business entity 22 Regulation of business.

As zakat is a tax rebate Azreens income tax in 2017 is RM200. The below reliefs are what you need to subtract from your income to determine your. Technical or management service fees are only liable to tax if the services are rendered in Malaysia.

Easy to update tax rates other variables for new tax years. With effect from YA 2020 a Small and Medium Enterprise SME resident in Malaysia is taxed at the rate of 17 on the first RM 600000 of the chargeable income of the company. Corporate - Taxes on corporate income.

Tax Rate of Company. Tax relief is ksh 1408 per month or ksh 16896 per annum. Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50 million are taxed at the following scale rates.

E corporate income tax rate is 24 effective from YA 2017. For corporate as prescribed under revenue memorandum order no. COMPANY TAX COMPUTATION - FORMAT ADD LESS RM RM NET PROFIT BEFORE TAX XX LESS.

RM500 lets call it IT Azreens has made a zakat contribution in 2017. This mechanism replaced the manual calculation submission and remission of tax. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai.

Section 43 B Expenses Interest On Bank LoanBonusPf Not Paid Till Return Filing Date 30 Sept xx. Income tax rates Resident individuals Chargeable income Rate Cumulative tax RM RM RM First 5000 0 5000 00 Next 15000 5001 20000 2 300 Next 15000 20001 35000 6 1200 Next 15000 35001 50000 11 2850. Marina ibrahim Page 1 7102014 COMPANY TAX COMPUTATION - FORMAT ADD LESS RM RM NET PROFIT BEFORE TAX XX LESS.

Any Cash Payment 20000 Of Any Expense Per Day. The SME company means company incorporated in Malaysia with a paid up capital of ordinary share of not more than RM25 million. Return Form RF Filing Programme For The Year 2021 Amendment 42021.

A prominent tax avoidance case is Sabah Berjaya Sdn Bhd v KPHDN 1993. Income TaxWealth taxInt On TaxPenalty On Tax Shown As ExpDeferred Tax. Lee arrived in Malaysia on 1 June 2010 and.

Malaysia Corporate Income Tax Calculator for YA 2020 Assessment of income in Malaysia is done on a current-year basis.

Malaysia Corporate Income Tax Rate Tax In Malaysia

Quiz Questions And Answers Taxation Quizzer Part 1 Basic Principles Of Taxation 1 Which Theory Studocu

Corporate Tax Planning In Malaysia Tax Options Tax Position

Company Tax Rates 2022 Atotaxrates Info

Payroll Accounting Small Business Entrepreneur Bookkeeping Keep It Simple Solopreneur Payroll Software Payroll Tax Software

Hong Kong Guide Profits Tax In Hong Kong Asia Briefing Country Guide Portal

Company Tax Rates 2022 Atotaxrates Info

Company Tax Computation Format 1

Malaysia Personal Income Tax Rate Tax Rate In Malaysia

Explore Our Image Of Monthly Spending Budget Template For Free Budgeting Worksheets Budget Template Excel Templates

Company Tax Computation Format 1

What Type Of Income Can Be Exempted From Income Tax In Malaysia

Form 1116 Step By Step Guide To Claim The Foreign Tax Credit

Understanding The Difference Between P45 P60 Payslips Online Tax Forms National Insurance Number Income Tax

Download Your Personal Tax Clearance Letter Cp22 Cp22a

How To Calculate Income Tax Tax Calculations Explained With Example By Yadnya Youtube